We’re back from an off-season hiatus, now that some of the patterns in the 2021 real estate market are starting to solidify. Each month, we will be posting an updated Market Outlook based on the questions we continue to receive from clients, employees, and investors about the implications for the housing and mortgage markets in which we are active (read our End of 2020 Housing Outlook).

We’re picking up right where we left off, with ever-declining inventories and a hyper-competitive housing market that’s showing no signs of weakness. Whatever headwinds the rising rates and foreclosures starting to come back may have introduced, demand pushed right through them - further draining inventories in all of our markets. Perhaps as vaccinations roll out and businesses begin to operate without restrictions in all markets we will see pent-up supply hit the market, but we haven’t seen that yet.

Versus this time last year, inventory of homes currently for sale are down between a minimum of -44.1% (Philadelphia) to a maximum -64.3% (Tampa) vs. last year in each of our markets. This has translated to anywhere from 1 month (Tampa/DC) to 1.9 (Philadelphia) months of inventory available in each of our markets (meaning all of the current inventory would go under contract in this time assuming the pace of sales continued and no new homes came on the market). It’s not clear how much further these numbers can decline from here. It’s almost mathematically impossible to sustain a pace of <1 month without running out of inventory entirely – essentially homes would have to be so in-demand that they never actually hit the open market as inventory cannot be sustained for any significant period of time. In fact, homes selling before even coming to market is a trend which we have seen happening more and more frequently.

However, given the low inventories, the amount of home sales has continued to grow year over year - between 4.3% (Philadelphia) and 15.4% (DC). And unsurprisingly, median home prices are up between 5.6% (DC) and 16.2% (Tampa) vs. last year.

In our Mid-Atlantic markets and Tampa, homes have sold at a blistering pace; days on market are down anywhere from -20% (DC, 24 days) to -38.5% (Baltimore, 32 days). Orlando (47 days) is an exception; days on market ticked up 2.2%, and the market exhibited a less rushed sales pace.

The big question that nobody has the answer to is, “when will inventory rise?” Normally, in the late winter and early spring we see a natural rise in inventory from January lows. We’ve yet to see that this year and the inventory of homes for sale actually declined from January to February, which is unusual.

Perhaps as we cross into the spring, we will see a later than usual burst of inventory. If we don’t, and we see continued demand from buyers, we could be looking at sustained substantial price appreciation of homes in all markets.

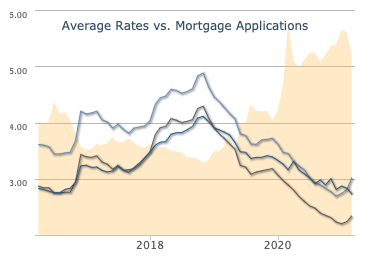

The only headwind that might continue to have an effect is that 30-year fixed mortgage rates have ticked up from an all-time low of 2.75% late last year to 3.26% at the time of this writing. This significantly affects the purchasing power of buyers and that may signal some reduction in demand in the future.

Source: mortgagenewsdaily.com

If last year was the best ever time to refinance, now might be the best ever time to sell a home.

If you’re planning to sell and also need to buy, time is of the essence because you have two out of three major factors working in your favor: a ultra-strong seller’s market and still low (but rising) interest rates. The one factor working against you is that it’s tough to be a buyer in this hyper-competitive market, but it’s better than the alternative scenario of having a home to sell that you can’t unload blocking you from purchasing your next home. Though more difficult, it is still possible to find quality homes in a low inventory market.