In our last market outlook, we were lamenting the severe lack of homes to purchase relative to demand, and were hoping to see some inventory increase to provide relief to the extreme seller’s market conditions.

The good news is that we did see a small uptick of inventory over the summer in July, but the bad news is that we trended right back down again in August, and are seeing new record lows for the month’s supply of inventory in some markets.

Bottom line: interest rates are low and there aren’t enough homes to go around which is fueling a sustained, ultra-competitive housing market.

Housing

Each of our local markets has exhibited some variation of this pattern: home prices have appreciated rapidly over the past two years, and inventory is way down in comparison to pre-pandemic levels.

Philadelphia

- The median home price in the Greater Philadelphia Region is up 26% from pre-pandemic levels. Comparing August 2019 vs. 2021, the median home price in the region has appreciated from $258,000 to $325,000 today.

- There are currently 1.2 months of inventory, which is down from 1.5 months last month in July. Historically speaking, these levels are still very low compared to a pre-pandemic inventory of around 3 months in August 2019.

Greater DC & Beltway

Greater Baltimore / Maryland

- Median home price is up 19% from Aug 2019 pre-pandemic levels. Home prices appreciated from $294,000 to $350,000 in this time.

- Inventory is down to 0.9 months, from 1.1 months in July. This summer is the first time we’ve seen months of inventory drop below DC levels in this region. We’ve noticed in our own customer migration patterns that many people are moving further away from the Beltway, and this is starting to show up in the inventory levels as well. Pre-pandemic inventory in this region was 3.5 months in August 2019.

- The average number of days on market is, however, up from a low point of 14 days in April, and now sits at 18 days.

Orlando

Tampa

- The median price in the Tampa region is up a whopping 35.6% from Aug 2019. In dollar terms, the median price jumped from $225,000 to $305,000.

- Inventory is down to an all-time low of 0.7 month, from 1 month in July. Typical conditions in Tampa pre-pandemic were also around 3 months of supply.

- Average days on market is up to 17 from an all-time low of 14 in July.

Jacksonville

- The median home price in the Jacksonville region rose 24.8% from $240,000 to $300,000 from Aug 2019 to Aug 2021.

- Inventory is down to 0.8 from pre-pandemic levels of 4 months of inventory, which is the largest shift we’ve seen in all of our markets and continues to trend down.

- Market activity in Jacksonville runs a bit slower compared to other markets, with days on market up to 33 from a low of 31 in June 2021.

Mortgage

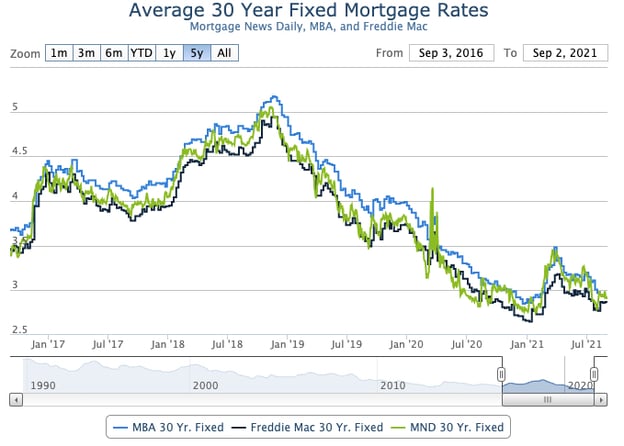

After spiking a bit from the all-time lows we saw earlier this year, the average 30 year fixed mortgage rate is trending back down. Nationally, rates climbed from the all-time low of 2.87% in Jan 2021 up to 3.42% in April 2021, and have from that point trended back to 2.93% and are seemingly continuing to drop.

We don’t know what the Fed will do, but between the Delta outbreak persisting and a weak August jobs report any “taper” seems unlikely and the low rates we are seeing are likely to persist or potentially even drop.

Conclusion

At this point it’s hard to expect any significant increase in inventory in the short term, though we did see a bit of a bounce in July and an uptick in average days on market in most of our regions, which signals a potential bit of softness to the current extreme levels.

So long as mortgage rates remain as low as they are now, homebuyers have an additional incentive to actively search – keeping competition high and reducing inventory.

If you’re in a position to buy and sell a home, now is still a prime time to do so. Despite the difficulties you may encounter as a buyer, you’re going to have two important factors working in your favor: extremely low-interest rates for your new home, and a strong seller’s market in which to sell your existing home.

If you’re selling a home, there are signs that competition is ebbing a bit when we compare late summer to early spring, so potential sellers who were on the fence may want to jump in now and cement their profit before we see an increase in average days on market and available inventory.