Katie Burrows-Stone becomes first customer in the Northeast to close a mortgage with the Movement Assistance Program.

For many aspiring homeowners, the biggest barrier is putting together a down payment. We hear it every day, so when one of our customers came to us with a solution, we knew we had to spread the word. Read how Katie Burrows-Stone learned how to afford a down payment, thanks to a unique new program from Movement Mortgage.

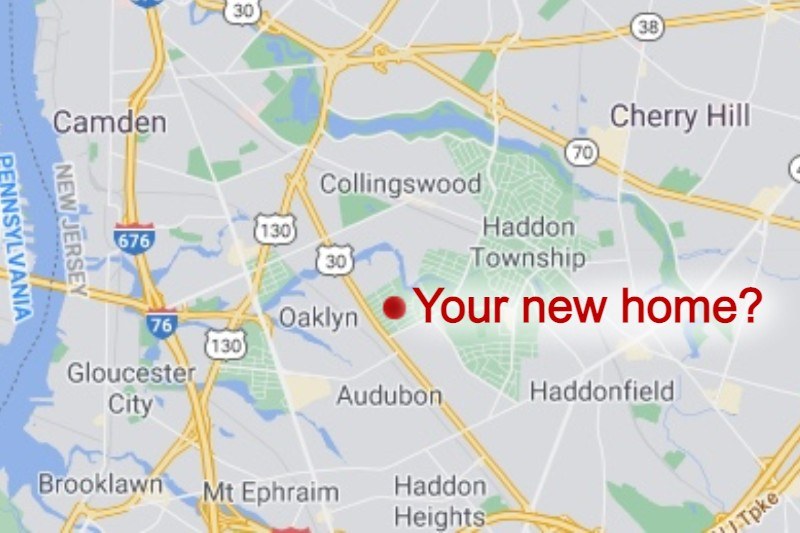

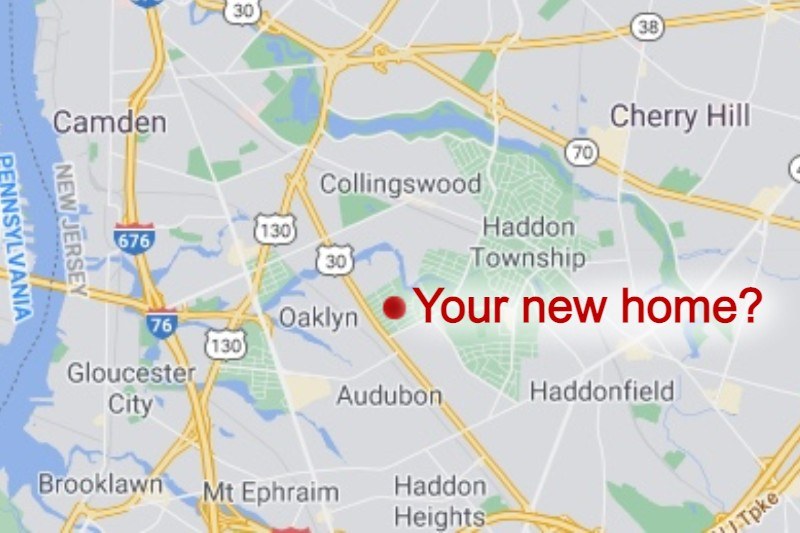

Katie and her husband loved living in Philadelphia’s Brewerytown neighborhood - they just didn’t love the rising rents. While they knew buying a home would save their family money in the long run, there was always the roadblock of putting up the down payment. As a high-school English teacher, however, Katie is no stranger to research, so she did some digging. What she found was the Movement Assistance Program, also known as MAP.

This custom, fixed-rate loan program was developed by Movement Mortgage to help first-time buyers achieve their dreams of home ownership. It offers up to 3% of a home’s sales price or appraised value as a down payment assistance grant, allows up to 4% of the closing costs to be covered by the seller, and even offers a 2-year job loss protection plan.

Katie, as it turns out, would become the first customer in the Northeast to qualify for and close a mortgage through MAP. With the couple's dream within reach, it all happened quickly. A property she had her eye on - just down the street from her current apartment - suddenly dipped in price. Katie knew she had to move quickly, so she reached out to our agent Chad Eason who cleared his schedule to show the couple the property.

Immediately, Katie and her husband fell in love with the rowhome's detailed brickwork, delicate archways, and outdoor patio. The very next morning, the couple made an offer and the rest is history.

If it sounds “too easy,” you’ll have to take Katie’s word for it. Pushing through the busiest time of her school year—grading 150 final papers and projects—she was worried that any additional paperwork would just pile up. However, Chad and Katie’s loan officer Terry Kravaris did everything they could to make the process seamless.

“Applying for the Movement Assistance Program was so easy, and both Terry and Chad were incredibly helpful and supportive every step of the way,” said Katie. “(They) worked around our schedule to make sure that we had all our questions answered and all our paperwork ready to go. It's a really great feeling to know that we now have a house of our own in a neighborhood that we love, and I can't wait to move in and make this house into our home.”

Katie was able to take full advantage of the Movement Assistance Program, even walking away with cash at the closing table. At Houwzer, we love helping people realize their dream of homeownership and were thrilled to be a part of Katie’s big win.

For more information on the Movement Assistance Program, visit https://movement.com/map/.