Note: This article is a rewrite from 2023, updated for current market conditions.

Are home prices dropping in 2024? It’s the question on a lot of homebuyer’s minds—and home sellers, too. Everyone is wondering how the shifting market is going to impact them.

What we’re currently experiencing could be called a housing market correction. Here’s why we don’t expect home prices to drop much in 2024—and keep reading to find out what’s expected from 2025.

Want to know specifics about a particular area? Start here.

Are home prices dropping? What the data shows

If you read newspaper headlines day after day, they can often leave you with a more dramatic impression of the housing market than what is really happening.

Take a quick temperature check and ask yourself how much you think median US housing prices fell in December, as compared to last year. Got a number in your head? Good.

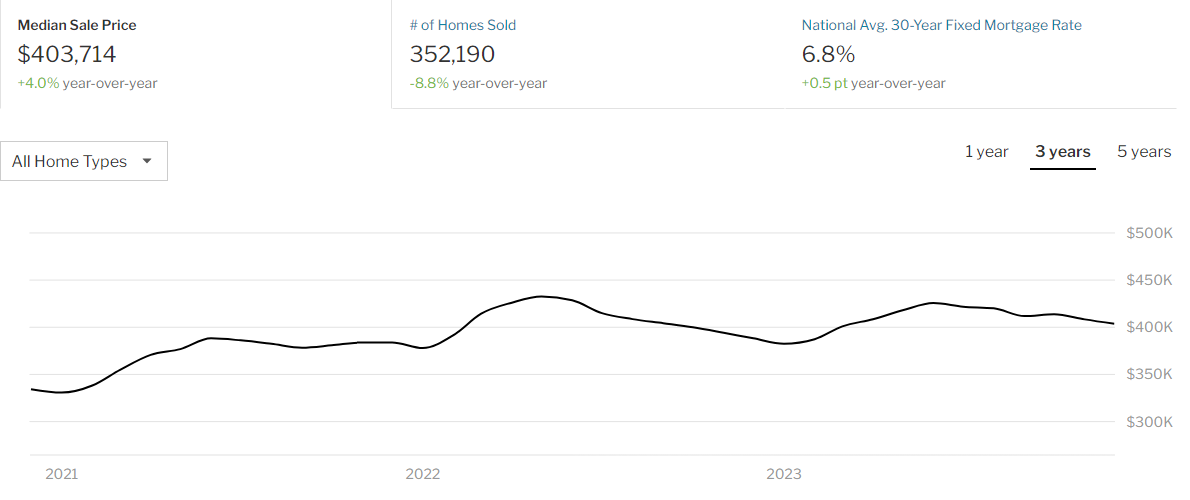

...the reality is that home prices were up 4% in December compared to last year, according to Redfin’s data. Of course, this might change as we move deeper into 2024. This is also national data, and smaller, local markets may experience a drop (or rise!) in price. But yes, overall, the price went up despite the mortgage rate rising a notable 0.5% over that same time.

So why is it happening? The short answer: supply and demand.

One of the major culprits here is the number of homes for sale. As the mortgage rate shot up, anyone who had a low mortgage rate was highly disincentivized to sell. Why go from a 4% to a 7% rate and ultimately get less house for your money? The number of homes for sale during this same period fell 6.1% compared to the same time last year. That’s a noticeable shrink in inventory, and it helps keep prices up. Serious buyers have to make competitive offers when there are so few choices on the market.

Until the mortgage rate goes up—or until sellers get tired of waiting—we’re unlikely to see a significant price drop. At the end of the day, there are always people who need to move and can’t wait to buy a house, and they’re willing to get a home on the higher end of their budget if it means not giving up on owning a home.

Data via Redfin: home price fluctuations over the past 3 years

Will 2024 be better for buyers?

The year is still young and we’re not quite at the spring market. So this begs the question: will 2024 be better for buyers than the past few years?

Plenty of industry experts agree that prices will likely remain similar to 2023, with potential small changes. However, no one can say for sure—and a lot of the market’s direction will ultimately be controlled by the interest rate.

If the interest rate shot down, home prices would likely go up as more buyers enter the market. However, the Fed has been trying to tamp down inflation, and keeping the borrowing rate high is their main way of controlling that. Though interest rates have been creeping back down, it's unlikely they'll reach the low rates we've seen in the past few years.

Fortunately, BrightMLS has predicted a silver lining: their experts are forecasting inventory to increase by approximately 8% throughout 2024.

Not a crash: a housing market correction

Although there’s no formal definition of a housing market correction, most experts would use it to describe a drop of 10% or less in price.

Considering that almost every industry expert is predicting a drop of less than 10% before prices level out and then begin rising again, it’s more accurate to say that what we’re experiencing right now is a correction to something closer to pre-pandemic housing prices, rather than an actual crash.

Average home prices in the United States soared, increasing approximately $120,500 in the last 5 years—so if the experts are right about this year, chances are that any small drop in price isn't nearly enough to get us back to pre-pandemic prices.

One way to set your expectations in line with what the market might correct to is by checking out what homes sold for in your desired neighborhood around the beginning of 2020. That can give you a better idea of what typical demand looked like before the extremely low pandemic-era rates kicked in—and you can assume that's the lowest prices will likely go during this correction era.

Will housing prices drop in 2024?

If you're thinking about buying a house but not sure whether to do so, it makes sense that you want to know what's likely to happen in 2024. Here's what the experts are predicting:

Bear in mind that homes have always appreciated in value long-term.

Will 2024 be a good time to buy a house?

If you need a house, can afford the monthly payments, and plan to live there for at least several years, 2024 is not a bad year to buy a house.

Are conditions ideal for a home buyer? Maybe not—but you’ll never have all the factors working in your favor. However, considering the market in recent years, 2024 may be the best conditions since pre-pandemic times.

Look on the bright side for 2024: home prices likely aren't falling by much, but they also aren't moving up. Also, though interest rates remain high, they are falling from their 2023 peak. Many homebuyers may still wait for further drops—meaning there's less competition for the homes that are on the market.

Resource: read about the difference between a 6.0% and 6.5% rate, and what refinancing looks like.

Buying now means you also start building your equity today, rather than putting rent money into a landlord's pocket. In ideal conditions, mortgage payments are often cheaper than rent payments—and if you purchase with a higher interest rate, you can plan to refinance once rates come down.

What’s the downside to waiting to buy a house?

If both interest rates and home prices could come down in the future, then why not wait? For some homebuyers, waiting will make the most sense.

However, it’s important to consider what you give up by waiting.

A house is a human need before it’s an investment vehicle. If you need an extra room to accommodate your growing family now—or a spare room to work from home—waiting a year can impact your quality of life. Waiting and waiting to save 1% or score a .5% lower interest rate might not be worth it in this sense.

Talk to an expert today to weigh your options—at no cost to you