Each month, we are posting an updated Market Outlook based on the questions we continue to receive from clients, employees, and investors about the implications for the housing and mortgage markets in which we are active (read June’s outlook here).

After the first full month of reopened businesses in many states, we are finally back to what feels like a normal spring market—except for the fact that the increased pace is likely to persist into the summer, making up for missed time during the shutdown months.

Though there is a current rise in cases in the majority of US states, we do not expect a second, near-complete shutdown like we saw in previous months. However, we do realize that there may still be significant headwinds ahead, and we are prepared to do our part in preventing the spread of the virus. We believe that we will be able to continue to conduct real estate transactions safely and in accordance with all government guidelines for the rest of the year.

Housing

Houwzer is continuing to see a huge increase in demand for real estate transactions across all our markets. We are continuing to set all-time records for homes put under agreement. We still believe the pent-up demand caused by the various shutdown orders is creating a surge in demand for our services, but we are cautiously optimistic that even as the pent-up demand works its way under contract there is still plenty of momentum. Our acquisition of new buyers and sellers continued at a rapid clip in June, and our pipelines are very deep.

Last month’s prediction for the continuation of the pre-COVID seller’s market proved accurate. The market has continued to shift to an even more pronounced seller’s market than we saw earlier in the year before COVID hit. Gone are any signs of softening or the market moving toward a buyer’s market.

In May, we saw inventory decrease sharply to around 1.9 months down from 4.5 months in our Greater Philadelphia market. In the Greater DC market, we saw 1 month down from 1.4 months of inventory in May, and in Greater Baltimore, we saw inventory decline to 1.4 to months from 2.2 months of inventory. These shifts indicate that buyers are continuing to buy voraciously and not enough new inventory is coming on to the market to meet demand.

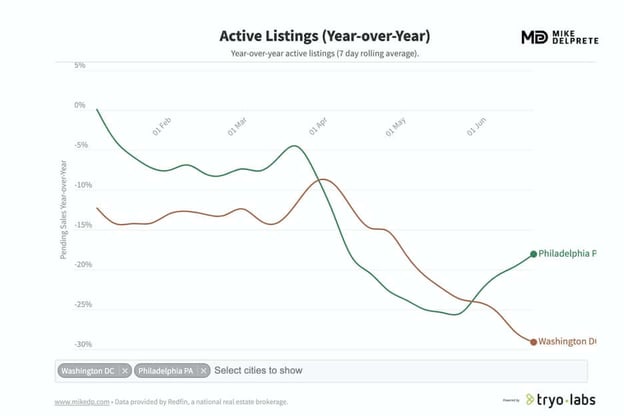

Lately, we’ve also been using Mike DelPrete’s excellent real estate market tracker to get a broader sense of local market conditions year-over-year:

We are finally back to growth in new listings in Philadelphia, and if current trends continue, we’ll be seeing the same in DC after -75% and -45% declines in the height of the pandemic shutdowns.

This much-needed inventory is being gobbled up by motivated buyers at a rapid and increasing clip:

And consequently, inventories continue to suffer:

It’s a great time to be selling a home, with increasing demand for homes and declining inventory levels.

Mortgage

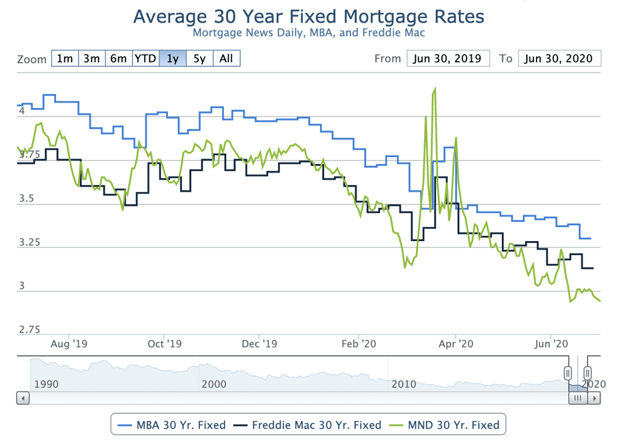

In the mortgage market, we’ve seen demand for refinancing abate slightly in the beginning of the month due to a slight uptick in rates, and then come roaring back as rates continued to dip and we ended up with the Best Month Ever for Mortgage Rates, with average rates dipping into the high 2s for the first time in history:

We said last month we believed it was the best period in history to refinance a home and that prediction came true. We don’t know how much room there is to go lower from here. Though we expect these conditions to persist, you can see from the historical pattern that when rates do rise, they tend to rise very sharply. We don’t know where the bottom will be but we are continuing to push all-time low rates.

If you plan on staying in your home it is probably worth speaking to our mortgage advisors to find out if refinancing can reduce your monthly mortgage payment, or allow you to take cash out of the equity in your home.

Even though the market has come roaring back across the board, we do recognize that the pandemic is still not over. We are hopeful that we can successfully navigate the current rise in cases and reverse the trend to limit the loss of human life and permanent damage to our local economies. We plan to do our part in making sure that happens by taking every precaution possible in the course of conducting our business, while still investing in growing our current markets, as well as pursuing growth into new markets.

- Mike Maher, Houwzer CEO