Each month, we are posting an updated Market Outlook based on the questions we continue to receive from clients, employees, and investors about the implications for the housing and mortgage markets in which we are active (read August’s Outlook here).

Just like last month, we’ve seen the ravenous demand for residential real estate persist across all of our markets despite a lot of countervailing narratives in the media around flight from cities, most notably in the NYTimes and the Wall Street Journal.

However, this narrative does not seem to hold true outside of New York and San Francisco. Highly-compensated workers in the finance and technology sectors have concentrated in those cities and are finally able to “relocate” their high wage jobs to a lower cost of living area. This is an arbitrage opportunity created by the fallout of the COVID-19 pandemic, but our perspective is that, like all arbitrages, it will be arbitraged out of existence fairly quickly. Cost of living will go up in these areas with the influx of higher income new residents, and if their employers decide to permanently shift to a remote work model, chances are their wages will not grow as fast as they did when they had to keep up with the cost of living in the most expensive living areas in the country. Over time, these workers may even be replaced with new remote workers who have never lived in a high cost of living area, and are willing to do the same work for a lower wage. This is an interesting phenomenon to watch, but it really is a phenomenon constrained to a small but relatively wealthy segment of the population in these specific markets, and not likely an example for real estate markets nationally.

In the principal cities of our current markets (Washington, DC, Philadelphia, Baltimore and Orlando) demand from home buyers is far outstripping the inventory available and there is no exodus in sight. In fact, if anything, we are on the receiving end of the above trend, on top of tremendous local demand. This persistently high demand coupled with low inventory is not only present in our markets. Almost the entire country, except for New York and San Francisco, is in the strongest seller’s market it has ever been in (this is a great explainer video explaining the phenomenon in more detail).

We do not know how long these conditions will last, but just like it was recently without a doubt the best ever time to get a mortgage, it is now without a doubt also the best time ever to sell a home.

Housing

There’s not a lot to say here other than inventories in our markets continue to push new lows once again. We’re down to 1.4 months of inventory in Greater Philadelphia, 1.5 months of inventory in Greater Baltimore, 1 month of inventory in Greater Washington, DC, and though we haven’t yet set up reporting in our newest market (hopefully for next month’s outlook), Greater Orlando, the Orlando Regional Realtor Association is currently reporting similar conditions.

If you’re thinking about selling a home in the near future, now is the time to sell. We’re heading into the fall market with a surging stock market, rock bottom interest rates, and less uncertainty due to COVID as time goes on. It’s unclear if these conditions will persist or if fundamentals will shift as the pandemic wears on, but it’s unlikely that we could realistically sustain any stronger of a seller’s market than what we currently are seeing.

Mortgage

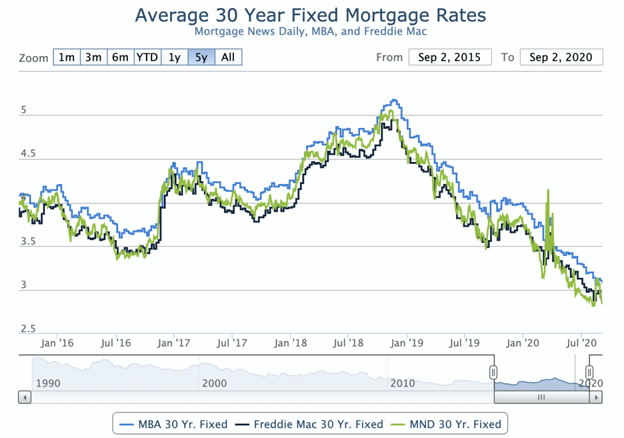

Mortgage rates are still running at almost all-time lows but there is some risk in the refinance market of a government intervention that will likely raise interest rates on refinancing by 0.5% overnight, if implemented as scheduled on December 1st, 2020. Our guidance is that if you are seeking to refinance, you should do so as soon as possible while rates are still low.

Purchase mortgages won’t be affected by this rule change, but we could be nearing an organic market bottom on mortgage interest rates even without the rule change. Recent trends have seen mortgage rates start to tick up from all-time lows. We don’t know if these trends will persist, but it is worth watching. Rising interest rates would also be an early indication of a shifting housing market. Higher rates would likely put a damper on the extreme seller’s market conditions we’re seeing.

If you’re planning to sell and also need to buy, now is also a good time to do so because you have two out of three major factors working in your favor: a strong seller’s market and low interest rates. The one factor working against you is that it’s tough to be a buyer in this hyper-competitive market, but it’s better than the alternative scenario of having a home to sell that you can’t unload blocking you from purchasing your next home.