Although DC may be best known for its awe-inspiring monuments and historical significance as the nation’s capital, it’s a vibrant city in its own right. Award-winning restaurants, trendy bars, and a top music scene have attracted plenty of businesses and residents alike.

If you’re new to the area and thinking about buying a home in DC, here’s what you should know.

1. The DC Housing Market is Competitive

DC real estate is expensive, and transplants to the city often experience initial sticker shock. While the current median sale price for homes in America is $377,000 according to Redfin, the median sale price for Washington, DC is $709,000.

"The most unique thing about the DC housing market is the pricing and the competitiveness," explains DC-based buyer agent Anita Mutumba. "That’s the most talked-about item with transplants. Even people who have lived here for a long time are shocked."

First-time home buyers often need to wait longer to embark on their DC housing search, and settle for a smaller space, than they might elsewhere in the country. Alternatively, many families opt to live in the nearby suburbs and surrounding towns of DC, which are easily accessible by public transportation. These areas include:

- Silver Spring (MD)

- Bethesda (MD)

- Hyattsville (MD)

- Fairfax (VA)

"Right now is not when you're going to find anything particularly affordable," warns Mutumba. "Even in the neighborhoods that used to be characterized as more affordable, you’re still starting at half a million for a fairly small place. The city, and everything around the city, is not at all what you’d call affordable."

Instead of narrowing your search to specific DC neighborhoods, she recommends working with an agent who understands your budget and can find a home to match. If you're looking for a DC Realtor, start here.

2. Property Disclosures in DC List Everything

If you’re buying a home in DC, home sellers are legally required to provide a complete property disclosure. This informs you, the buyer, of everything you need to know about the condition of the home, including things like the condition of the roof and the working status of appliances like the dishwasher.

Be aware, though, that if you’re buying a home near Washington DC - rather than directly inside of it - the laws surrounding property disclosure (and other aspects of the home purchase!) differ. In Virginia, for example, the seller has no legal responsibility to disclose anything (in other words, it’s a “buyer beware” state).

3. It’s an Old City, So Expect Old Homes

DC is one of the oldest cities in the U.S. - not surprisingly, it has some pretty old homes as well.

This interactive map via National Trust for Historic Preservation shows how old DC homes are, and it’s easy to see that many of them are from 1920 or even earlier - a full century old.

"It’s characteristic to have old radiators in units; you’re going to see that throughout the city," explains Mutumba. While transplants to the city may find their appearance jarring, she says that as long as a radiator has been well maintained, sometimes the easiest thing to do is just to buy a cover that hides it from view. "Basements in the city tend to be a lot lower as far as height, so the basement is more than likely going to be your storage space," she adds.

Other things to look out for in old homes include:

The reality is that older homes need more maintenance than newer homes. This is why it’s important to work with an experienced local buyer agent: they’ll be able to point out the issues with potential homes so that you can make an offer that reflects their current condition.

4. Property Taxes in Washington, DC are Relatively Low

Your residential property tax rate is an important thing to know before buying a home in Washington, DC. The tax rate on residential property in DC is $0.85 per $100 in assessed value - for a $500,000 home, that amounts to $4,250.

However, the average effective property tax rate (this is after typical deductions and credits) is 0.56% - this is fairly low compared to the rest of the U.S. This means that if you buy a home worth $500,000, you can expect to pay around $2,750 in taxes each year. To find out how much you’d owe in taxes for your new home, check out Smart Asset’s property tax calculator.

Buying and selling a home also involves transfer and recordation taxes.

- For homes that sell for under $400,000, the DC rate is 1.1% for both transfer and recordation (or 2.2% total).

- For homes that sell for $400,000 or more, the rate is 1.45% for both transfer and recordation (or 2.9% total).

In DC, the seller usually covers transfer tax while the buyer pays for the deed recordation tax. For a $500,000 home, the buyer would end up paying $7,250.

5. Renting Out a Home in DC Can be Tricky

If you’re thinking about buying a property and renting it out, fully familiarize yourself with DC’s renting regulations, which could be said to more heavily favor the renter compared to other locales. You cannot legally charge more than one month’s rent as a security deposit, for example.

DC also has additional protected classes - you may already know that you can’t discriminate against potential tenants for reasons of race or religion, but in DC there are 12 additional protected classes. You can’t discriminate against someone for their source of income or personal appearance, for example.

In DC, landlords interested in selling their house must also give tenants written notice of the option to purchase their home prior to moving forward with a traditional listing (this is known as TOPA - or Tenant Opportunity to Purchase Act). Make sure to review landlord/tenant laws in DC before moving forward.

6. DC is Good for Investing but Bad for Flipping

Although DC can be a pricier market to invest in, this is a city where you’re likely to see a good return. According to Redfin, the average price of a DC home was:

- 5 years ago: $552,500

- 1 year ago: $620,000

- Today: $709,000

That’s up 14.4% since last year, and 28.3% from five years ago. DC represents a fairly safe investment because it’s the nation’s capital - the government employs nearly a quarter of a million people here. This means there is consistent demand for homes in the area.

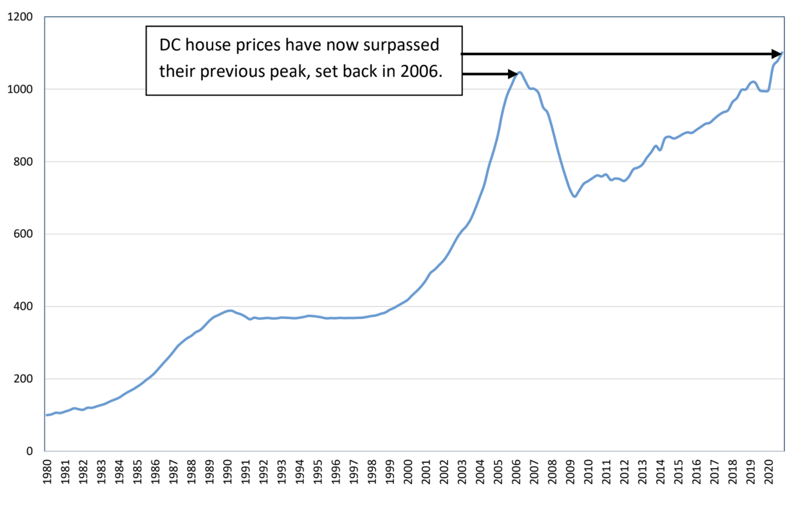

Graph via the DC housing report

If you’re interested in moving into an up-and-coming neighborhood in DC, take a look at:

- Deanwood (average sale price $435,000)

- Lilyponds (average sale price $459,000)

- Anacostia (average sale price $530,000)

- Michigan Park (average sale price $560,000)

"Right now, there’s a lot of interest in the Anacostia area," explains Mutumba. "There’s been a lot of commercial teams coming in, a lot more business coming in, so the home prices are starting to go up. If you were going to invest that would be a good place. East of the river, in general, is good - it allows a little bit more flexibility because the market there isn’t super saturated like in Petworth or Georgetown."

On the “flip” side, DC can be a difficult place to flip property because of the high cost of housing. In cities like Baltimore, it’s possible to find foreclosed homes for $50,000 or even less. In DC, though, you’d be lucky to find an empty lot for that price. Urban Turf documents how the profit for flipped homes in DC has been falling - and due to lower margins, DC never makes the lists of top cities for house flips in the U.S.

7. Home Loan Assistance Programs in DC

First-time home buyers typically qualify for different types of buying assistance, and in DC this is no different. Each program typically has qualifying income and/or loan maximums.

HPAP provides interest-free loans and closing cost assistance to qualified applicants.

- For first time home buyers with good credit ratings

- Applicants can receive up to $80,000 in gap financing assistance

- Applicants can receive up to $4,000 in closing cost assistance

- Available to applicants earning up to 110% of the area median income (AMI)

- The loan is deferred for those with income below 80% of area median until the home is sold, refinanced, rented out, etc.

- 1st trust loan amount can’t exceed the conventional conforming loan limit ($548,250)

With DC Open Doors qualified homebuyers can access home purchase loans at below-market interest rates, along with down payment and closing cost assistance.

- For all homebuyers, not just first-time buyers

- Maximum borrower income of $151,200

- Maximum debt-to-income (DTI) ratio of 50% (max DTI for FHA loan is 45%)

- 1st trust loan amount can’t exceed the conventional conforming limit ($548,250)

- No maximum sales price limit

Talk to a local agent about this today

Further Reading