Houwzer's Market Outlook is based on the questions we continue to receive from clients, employees, and investors about the implications for the housing and mortgage markets in which we are active.

Now that some of the patterns in the 2022 real estate market are starting to solidify, it's worth examining what the rest of the year may hold for home sellers and home buyers.

Was May 2022 the Market Top for Housing?

Stock Markets have pulled firmly into bear territory, the US may already be in midst of a recession, cryptocurrency markets are in full meltdown mode, and inflation is at a historical high. The Fed announced a huge interest rate hike and presented a forecast implying many more large hikes on the way.

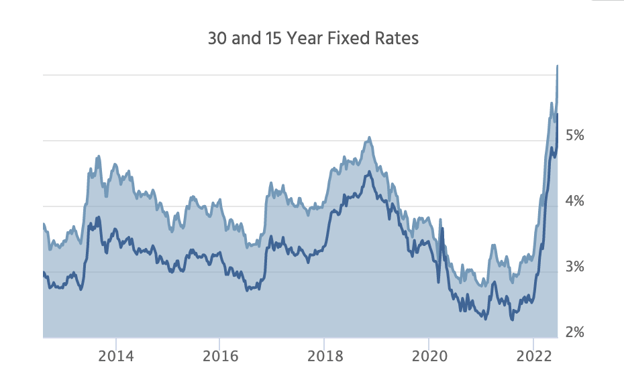

So far, the main effect of all this on the housing market is a surge in interest rates. In less than one year we’ve gone from typical 30-year fixed mortgage rates just under 3% to around 6% today:

Source: Mortgage News Daily

Somehow, all of this turmoil has yet to put a dent in home prices in any of our markets. Perhaps more surprisingly, we haven’t seen any strong signal that homebuyer demand is declining enough to move the housing market out of the persistent extreme seller’s market condition we’ve been experiencing for the last two years.

In fact, the signal of weakened demand is a significant reduction in the number of homes going under contract year over year in four out of five of our markets (Philadelphia, DC/Baltimore, Orlando, and Jacksonville) and very small upticks in month’s supply of inventory in the two (DC/Baltimore and Tampa).

Based on this data alone, it’s hard to extrapolate any imminent market slowdown for housing. Based on the pain felt across nearly every other asset class, it feels to market participants that the housing market must be ready to turn as well. While the reduction in contracts year over year is potentially a very early signal of possible future increases in inventory, this month would need to be the start of a continued trend over time for this to play out.

This trend of fewer homes going under contract may continue into next month, but even then it will take many months or even years for enough inventory to work its way into the market that the market balances, or to create year-over-year home price declines.

In fact, neither a balanced market nor price declines are a guarantee (or even necessarily likely) despite consumer perceptions of a market turn in the near or medium-term, given how few houses are available compared to the number of buyers still looking for a home to buy.

Philadelphia Market

- Median Home Price: $345,000 (up 11.29% from May 2021)

- Average Sales Price to Original Price: 104.22% (vs. 102.45% in May 2021)

- Average Days on Market: 18 (vs. 19 in May 2021)

- Month’s Supply of Inventory: 1.2 months (same as May 2021)

- Homes Under Contract: 6,619 (down -10.69% vs. May 2021)

DC/Baltimore Market

- Median Home Price: $603,000 (up 11.29% from May 2021)

- Average Sales Price to Original Price: 104.28% (vs. 103.85% in May 2021)

- Average Days on Market: 12 (vs. 13 in May 2021)

- Month’s Supply of Inventory: 0.9 months (up slightly from 0.8 in May 2021)

- Homes Under Contract: 7,452 (down -17.42% vs. May 2021)

Orlando Market

- Median Home Price: $400,000 (up 22.7% from May 2021)

- Average Sales Price to Original Price: 101.74% (vs. 99.65% in May 2021)

- Average Days on Market: 13 (vs. 19 in May 2021)

- Month’s Supply of Inventory: 0.9 months (same as May 2021)

- Homes Under Contract: 2,759 (down -11.29% vs. May 2021)

Tampa Market

- Median Home Price: $371,500 (up 28.5% from May 2021)

- Average Sales Price to Original Price: 100.88% (vs. 100.16% in May 2021)

- Average Days on Market: 13 (vs. 16 in May 2021)

- Month’s Supply of Inventory: 1 month (up from 0.8 in May 2021)

- Homes Under Contract: 6,430 (down -0.43% vs. May 2021)

Jacksonville Market

- Median Home Price: $365,000 (up 25.43% from May 2021)

- Average Sales Price to Original Price: 100.34% (vs. 100.45% in May 2021)

- Average Days on Market: 28 (vs. 33 in May 2021)

- Month’s Supply of Inventory: 1.3 months (same as May 2021)

- Homes Under Contract: 3,236 (down -9.43% vs. May 2021)

Is it a Good Time to Sell a House?

Based on this data, it's still an excellent time to sell a house in our local markets. Median home prices are up, houses are going under contract swiftly, and there is still a shockingly low inventory of homes available nationwide - giving sellers the upper hand.

However, it's worth keeping in mind that the market can shift swiftly in response to larger pressures (inflation, rising interest rates, etc). Buyers now have less buying power than they did one year prior, and the threat of a recession is often enough to cause buyers to pause in their search - even before their wallets start to feel the pinch.

Is it a Good Time to Buy a House?

Based on the data, the tables haven't turned yet to a point where buyers have a significant advantage when compared to last year. Buyers can still expect intense competition for homes and the need to drop as many contingencies as possible.

Anecdotally, some agents have reported experiencing a shift as fewer offers come in, and buyers who were getting outbid for months on end are finally going under contract. As we've covered in Will You Lose Money if You Buy a House Right Now?, there are always advantages to buying a home - regardless of the market. If you have a 5-year plan in place, it's rarely a "bad" time to buy.

Talk to a local agent about this today