Real Estate Commissions Explained

Posted on Nov 23, 2021

In the complex world of real estate, commission rates can seem like a black box. Understanding the...

Posted on Nov 23, 2021

Realtor commissions remain a contentious part of real estate. Homeowners often wonder whether their agent truly did enough work to justify the expense.

How do Realtor commissions work, and are the fees justified? Here’s what you need to know.

In a typical real estate transaction, 3% of the home’s sale price goes to the listing agent, and 3% goes to the buyer’s agent, for a total of 6%. If you’re selling a $600,000 home, for example, this would amount to $36,000 in commission fees. This is how agents are paid for their work.

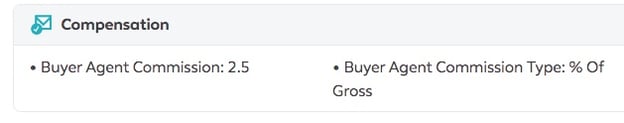

As per convention, the seller pays the cost for both agents. The listing agreement sets the price for both the buyer agent and the listing agent - so if you view a home for sale on Trulia, for example, it will already say what the buyer’s anticipated commission is:

Although a 3%/3% split is the most typical commission you’ll encounter, there exists a range. According to Real Trends, a Colorado-based research firm, the average Realtor fees for 2020 were 4.94% in total.

How? Well, it averages out. Some Realtors will charge more for their time if they’re selling inexpensive homes - for example, some agents set a commission rate of 3% or $10,000, whichever is higher - while others, like low commission/discount brokerages, will charge as little as 1%. Agents charging 1% will usually offer a more limited range of services to their clients (so you might not benefit from professional photography, open houses, etc). They typically still offer 3% to the buyer’s agent, so even though it’s advertised as a 1% listing commission, it’s really 4% that the seller is paying in total.

Houwzer charges a 1% listing fee for all homes (with 2-3% to the buyer’s agent recommended), regardless of price point. Unlike discount brokerages, however, Houwzer agents are backed by a full-service team and clients get all the services they would normally get with a traditional agent.

Any Realtor working through a brokerage only keeps a percentage of their commission - they have to pay out to the brokerage, too. Each brokerage sets its own commission split, and agents within a brokerage often have different commission splits depending on how many homes they buy or sell (and for how much).

Berkshire Hathaway, for example, typically starts agents on a 60/40 commission split - so the agent receives 60% and the brokerage receives 40%. On top of this, agents often have to pay various desk fees, insurance fees, etc. Sometimes agents may have a higher commission split, but have to pay a higher flat rate for fees. Agents agree to pay brokerage fees because they benefit from the brokerage’s marketing, office space, technology solutions, and more.

On top of all this, most agents are 1099 contractors, rather than employees - meaning that they live off their commissions (not a salary) and have to pay for things like their licensing fees ($100-$500 annually) themselves.

One of the reasons Houwzer decided to pay agents a salary with benefits, rather than opt for the traditional 1099 structure, is that it’s mutually beneficial to agents and clients.

The problem with the traditional commission structure is that it’s almost impossible for agents to 100% ignore the amount of money they’d make closing a deal.

“I had agents at brokerages I worked with in the past coming to me for commission advances to pay for baby formula - I wonder how secure they felt in telling their clients they shouldn't buy a house? And that's not to say they were bad people, or had low ethics - but it’s a conflict of interest,” explains Houwzer COO Ted Mucellin.

When agents don’t need to buy or sell a home in order to put food on the table, pay their mortgage, or cover their health insurance, it’s easier to be 100% honest with clients. When client satisfaction is the number one focus, rather than commissions, everyone wins.

“At Houwzer, you’re being paid a salary to give the best advice to that person possible,” says Mucellin. “If the only thing you’re paid for is getting the deal closed, then that may be all you worry about. But if you’re paid a salary for a whole set of behaviors, standards, protocols, and processes, then that’s what you care about - and that’s what we do at Houwzer. That often happens in traditional real estate, but there’s plenty of times it doesn’t. While at Houwzer, there’s sort of a guaranteed consistency because of that salary, compensation structure, and relationship.”

Commission is, very simply, calculated as a percentage of the home sale.

So for a $600,000 home and a standard 6% commission, that’s sale price x (percentage/100) = Commission fee, or $600,000 (6/100)= $36,000.

The Realtor fee comes from the home sale price before repairs or deductions to account for repairs, not after.

People often think real estate commissions should go the way of the dinosaurs, but in truth, there is a lot of work that agents do behind the scenes of a home sale or home purchase. Helping clients find homes, or find buyers for homes, is just one small part of the job.

A good agent will often make the process look effortless, but the average real estate transaction today now involves hundreds of pieces of paperwork, and home sales rarely close without any hiccups.

“If you limit your understanding of agent services to finding your next home, or finding someone to buy your home, then almost no fee is justifiable,” agrees Mucellin. “But if you come to understand all the steps and negotiation and knowledge and expertise needed to guide a client all the way through a sale of a home, then I don’t know how you could imagine ever doing it without an agent.”

When it comes to selling a home, there’s time, marketing, and negotiation expertise required. Overpricing your home can actually lead to a loss of profit, for example - so having an agent’s guidance is essential for pricing your home right and maximizing your profits. And professional photography, signage, and MLS postings all cost money.

“When it comes to listing: we believe it should not cost 3% to sell your house. It may have, once upon a time," says Mucellin. "With the technological innovations we’ve seen, in this case, the marketplace is supported by multiple listing services online - so that portion of the work, the listing aspect, has been greatly reduced. The remaining work on the sell side, though, is still significant.”

Here are a few of the things (but not all) your listing agent will handle:

“What happens if, midway, the buyer has challenges? Do you work with the buyer on that, or do you move on?” asks Mucellin. Often, there is no single “right answer” that home sellers can look up on Google, which is why the years of experience a listing agent brings to the table matters.

“Most people wouldn't dream of doing their own plumbing - are you really going to trust the most important financial decision of your life to what you learned on the internet?” asks Mucellin. “You don’t want to do it yourself. Trust me, you want an experienced professional - which is also a vote in favor of Houwzer agents, because they're trained, they’re supervised, they are monitored and they have plenty of deals so they're not just fly-by-night hobbyists.”

Because of the work involved with every sale, Houwzer has landed on $5,000 as a fair fee for listing services.

“We don't think it costs 3% to sell a house - that’s why we don’t charge 3%,” Mucellin explains. “But for the dozens and dozens of hours of work, and cost of things like professional photos and licensure, and to be on a professional listing service - we feel 1% is appropriate.”

Homebuyers often ask: “I did the work of finding the home, so shouldn't I get a discount?” However, finding the home only represents a small fraction of what an agent does for their client. When it comes to buying a home, there’s time, local market knowledge, and negotiation expertise required. The average home buyer now views 10 homes before finding “the one” - and behind the scenes, your Realtor is researching these homes, communicating with the listing agent, and evaluating.

“Sure, if you’re a buyer, you can look online,” Mucellin observes. “But, especially in today’s market, which is ultra-competitive, an agent will advise you on how to make an offer. Then once the home goes under contract, you have to do inspections - what is a fixable thing that you shouldn’t be freaked out by, and what’s potentially a real headache that fundamentally changes the value of that home? How do you navigate that? When should you give leeway to the listing agent if there’s a problem with the title? When should you walk away because you're just wasting your time?”

Here are a few of the things (but not all) your buyer agent will handle:

In many ways, your real estate agent serves as a sort of insurance policy on one of the largest financial transactions of your life. You want someone who has extensive experience in evaluating homes and evaluating real estate transactions to represent you - otherwise, you’re liable to make expensive errors.

“You could google some of that stuff, or you could work with someone who’s done it dozens of times. If you're making a $500,000 purchase/investment, do you really want to save $20,000 - which you’re not paying out of pocket anyway - to hope you get it right? You could spend $20,000 just replacing a roof or on any major issue with the house," warns Mucellin.

This is why experience is essential: an agent knows how to interpret the inspection report and can advise you as to whether a hole in the roof is a cosmetic issue or a major problem.

For this reason, Houwzer has determined that a 2-3% commission for the buyer’s agent and a 1% fee for the listing agent is a fair real estate commission.

As a seller, you might be wondering whether you can simply opt to not pay the buyer agent’s commission - or perhaps pay a lot less (like 1%).

The problem with this plan of action is that your home’s MLS listing will clearly state the commission cut the buyer receives.

When you offer little or no money to the buyer’s agent, it sends a signal that you don’t really understand the home selling process or that you’re going to be a very difficult seller to work with - and that’s something both home buyers and their agents want to avoid.

“To get to the point where the home is on the market with no fee/extremely low fee is a red flag. What happens if there’s an issue with the inspection, or with mortgage? There are 100 points during the transaction where you just need to work in good faith with the other party, and if from day 1 they’re saying 'I’m not paying the representative of the other party, even though that’s normal business' - that’s a bad sign," explains Mucellin.

If the buyer client wants to see a property that doesn’t have a commission, it puts the buyer agent in a difficult position. The majority of buyer agents, if they agreed to show their clients the home, would either ask for a re-negotiated contract from the seller or would ask for their fee to come in the form of additional closing costs from the buyer (which the buyer is not going to like).

This ultimately creates a poor selling experience for you - homebuyers will end up skipping your home to avoid financial complications. If fewer buyers come to see your home, you’ll likely get fewer offers - if any at all. And it’s competition that ultimately drives profits and fewer contingencies for home sellers. If all you get is one offer for $20,000 less than you wanted, you may have no choice but to accept it (especially if you need to move and can’t wait). In other words, you might end up losing a lot more money than you “save” by cutting the buyer’s commission.

There are several ways to reduce your commission fees. One way is to negotiate with your agent: ask if they would be willing to do 2.5% commission instead of 3%, in addition to setting the buyer’s commission at 2.5%. Whether or not they will agree to a discount will often depend on the brokerage and other factors (such as how much your home is expected to sell for).

It’s worth noting that, although there are plenty of articles online about negotiating commissions, the Consumer Federation of America conducted a national survey of over 200 agents and found that only 27% were actually willing to negotiate their standard commission rate - so while it can be worth asking, be prepared to hear “no” from the majority of agents.

Subscribe to our newsletter to get essential real estate insights.

Posted on Nov 23, 2021

In the complex world of real estate, commission rates can seem like a black box. Understanding the...

Posted on Nov 23, 2021

Home inspections are an integral part of the homebuying process. Hundreds of buyers opted out of...

Posted on Nov 23, 2021

Not every city is a great match for home flippers. Cities where the average home price is high...