How to Actually Lower Your Mortgage Rate

Posted on Dec 16, 2022

Rates have risen to historic highs, and we're not sure they're coming back down anytime soon. Read...

Posted on Dec 16, 2022

For homebuyers who can’t afford to buy their home in cash, a mortgage is a necessity. Yet despite a mortgage being one of the most important transactions of most people’s lives, many would-be homebuyers are woefully unprepared to understand their options and get the best deal.

Interested in knowing more about your options before you get to the closing table? Here’s what you need to know about the mortgage process.

Let’s start at the beginning. A mortgage is a monetary loan from a lender, given to a borrower, to purchase a property. The collateral for the home is the home itself - in other words, the lender will repossess and sell the home if homeowners don’t pay their monthly mortgage payments.

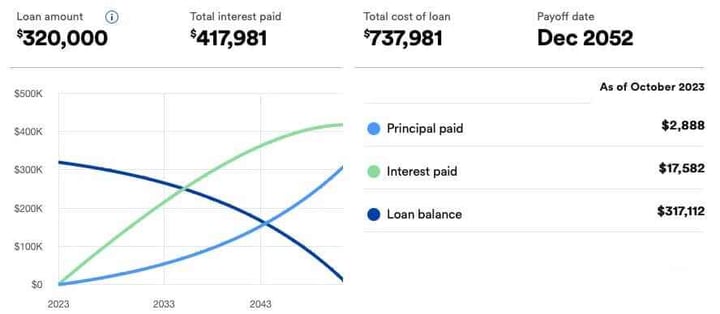

The interest you pay on your mortgage is front-loaded, meaning that the majority of the monthly payment when you first buy the home goes toward paying off interest. By the end of the loan term, the majority of your payment pays down the principal balance (the initial loan amount before interest).

Lending is a big business, which is why your personal bank has likely advertised its home loan services to you.

Don’t just go with the first big bank you come across! In many cases homebuyers are able to get a better deal by shopping around for better rates/loans. Most lenders will offer slightly different rates and over the lifetime of your loan, the difference could translate to hundreds or thousands of dollars.

The problem, of course, is that shopping around for rates can be time-consuming and confusing. That’s why Houwzer’s mortgage team does the shopping around for you - you’ll receive a personalized loan solution and a great rate.

“Unlike most Mortgage Advisors, we do not work on commission. Our job is to find the best mortgage product and the lowest possible rate for our clients," says Robert Wagner, a senior mortgage advisor at Houwzer.

You might be wondering what you need in order to qualify for a loan. Although every loan situation is unique, there are a few key qualifications that every lender is looking for.

It's easy to get these two terms confused, but they are not interchangeable: here's what they mean.

Getting pre-approved for your mortgage is a vital part of the home search.

A mortgage pre-approval is a letter from a lender indicating the type of loan you qualify for. The pre-approval is important for signaling to home sellers that you’re serious - and that you actually have the means to purchase the house. It also allows you to know your true budget so that you don’t waste your time looking at homes you can’t afford.

If you’re pre-approved for a smaller amount than you expected, you may need to adjust your home search accordingly. And yes, your credit will be pulled when you apply for a mortgage pre-approval.

There are five basic things you’ll need to get pre-approved by your lender:

Generally speaking, it’s best to avoid any large unexplained deposits to your bank account, significant new debt (like car payments), or new mortgages before applying for a loan and before closing on your home. Home purchases can be and have been derailed due to people buying new cars in the middle of the approval process.

"I had a client who was selling and buying a house at the same time, and his brother was so excited about the money they were making from the sale (it was an estate), he bought a brand new car a week before closing, and almost derailed the purchase side. He thought he could take out a loan and just pay it back with the sale proceeds," warns Muoki Musau, a Virginia-based buyer agent. "If you want to buy anything outside of the norm, run it by your lender first. It’s not only that buyers make large purchases that get them in hot water, it’s that they don’t disclose it. The more insight a lender has, the more options they can offer."

You also don’t need to get a loan from the lender you’re pre-approved by - though most people do.

Pre-qualification is a faster process. You’ll submit information about your credit, debt, and income to the lender, and they will estimate how much you could borrow.

Because the pre-qualification doesn’t look into credit history or borrowing ability, it’s not as comprehensive or as accurate as a pre-approval. The lender isn’t double checking the information you give them as they would with a pre-approval.

Pre-qualifying can be a useful tool if you want to gain a rough understanding of what your budget is and what you might qualify for.

The loan pre-approval is a deeper dive into your finances and will let you know the exact amount you can borrow as well as the interest rate you’d qualify for. It can also help speed up the home buying process.

You do not need to get pre-qualified in order to get pre-approved, and pre-approvals are more likely to signal that you’re a serious buyer.

The mortgage term refers to the number of years you have to repay the loan. The most common mortgage terms are 15, 20, and 30 years, with 30 being the most common (70% of mortgages). A shorter loan term means a lower mortgage rate (and more money saved over the life of the loan) but a higher monthly payment.

If you financed a $400,000 loan, this is how the term can affect your payments:

You’ll likely encounter several different loan definitions while exploring your options. Here’s what they all mean.

Conforming mortgages meet Fannie Mae and Freddie Mac guidelines - Fannie and Freddie are federally backed home mortgage companies created by the United States Congress. Their guidelines cover things like borrower credit score, documentation requirements, and debt-to-income ratio minimums. Lenders sell your loan to investors like Fannie and Freddie, which then securitize and sell the loans to investors.

A conventional loan is a conforming loan and adheres to certain loan requirements, such as the credit score minimum of 620, loan size, down payment requirements depending on your income, etc. You’ll also need to pay Private Mortgage Insurance if you put down less than 20%. A VA or FHA loan are not conventional loans.

Non-conforming loans don’t adhere to Fannie Mae and Freddie Mac Guidelines. This can be due to something like a low credit score on the part of the borrower, or a too-high debt-to-income ratio. A jumbo loan is also a non-conforming loan. A non-conforming loan typically comes with a higher rate, since it’s harder for lenders to sell to investors.

Jumbo mortgages exceed the monetary limits set by the Federal Housing Finance Agency (FHFA), and they are non-conforming loans. FHFA determines the conforming loan limit by county, which are reviewed and updated annually. Counties with higher home values have a higher baseline limit. Jumbo loans are often used to purchase luxury homes. The loan requirements for this type of loan are more stringent - you’ll need a credit score of 700 or above, for example.

The majority of mortgages are fixed-rate mortgages, meaning that the same interest rate will apply for the entire loan term. So if your mortgage rate at the beginning of your loan is 4%, it will be 4% at the end as well.

As the name suggests, an adjustable rate adjusts over time based on market conditions. The adjustable rate period kicks in after an initial-fixed rate period - for a 7/1 ARM loan, your interest rate will be fixed for the first 7 years, then adjust (usually every year). The fixed-rate you receive for the first 7 years of the ARM will be lower than the rate you’d receive for a 30-year fixed-rate loan.

Muslim home buyers might wonder whether having a mortgage is halal or haram, since it involves interest on the loan. According to Islamic scholars, “riba,” or interest, is prohibited (haram).

This means that many Muslims don’t wish to receive a traditional mortgage. Luckily, there are several Islam financing institutions in the U.S. that have workarounds for this problem.

One common workaround is that the buyer and the lender both own a portion of the home, and the buyer will pay the lender rent for living in the home until the loan is paid off. This allows the lender to profit, without taking interest.

When you borrow money for a home, you pay interest every month on the borrowed amount. The mortgage rate is the interest charged - whether that’s 3% or 6% on the loan. The mortgage rate you receive depends on a wide variety of factors, such as your loan term, your credit score, and the type of loan you opt for (adjustable vs. fixed).

When you’re trying to understand the difference between 5 and 5.5%, at first glance the difference seems trivial - but even .5% can impact your ability to finance a home.

Here are the monthly payments for a standard $400,000 mortgage and a 30-year term:

As you can imagine, over the lifetime of the loan the numbers are even more dramatic: in the above scenario, a 5% interest rate costs about $85,500 more over 30 years than a 4% interest rate.

A higher mortgage rate will directly impact how expensive of a house your lender will be willing to cover.

You may notice that many lenders may list “today’s interest rate” for different fixed rate terms. However, this number is not likely to be an exact match to the rates you will personally receive - it’s more of a ballpark, and it specifically defines the average 30-year fixed rate.

So what influences the actual mortgage rate you receive?

Actions taken by the Federal Reserve Bank in response to inflation, recessions, etc. influence the mortgage rate. When inflation was on the rise, the Fed increased the fed funds rate. The mortgage rate is not synonymous with the fed fund rate, but they typically move in tandem.

People often assume that if they receive credit card offers in the mail, their credit score is good enough to qualify for a mortgage. Not so! Similarly, having a large down payment doesn’t cancel out a bad credit score.

From How do People Afford Houses?, here’s the difference between a low and a high credit score when it comes to monthly mortgage payments for a $430,000 loan with 10% down:

Wondering how to fix your credit to buy a house? Resource:Can I Buy a House with Bad Credit?

When you have more of a financial stake in your home, lenders perceive the investment as lower risk - meaning you typically receive a more competitive interest rate offer.

it’s a good idea to shop around for your mortgage rate, because most lenders will offer a slightly different rate. Shopping around can save you thousands of dollars over the lifetime of your loan.

The majority of mortgages are fixed rate mortgages - but that isn't the only option for the market.

With a fixed rate mortgage, your interest rate remains stable over the lifetime of the loan. Fixed rate mortgages are the most popular type of home financing because the costs are predictable: you’ll pay the same amount every month until the end of the loan term. This makes budgeting easier.

With an adjustable rate mortgage, your mortgage rate will adjust up or down at pre-disclosed intervals (every month, quarter, or year is typical). This can be good or bad depending on the current mortgage rates - but it means that your costs are less predictable over time.

ARMs today often come with fixed rate intervals in the beginning of 3, 5, 7, or 10 years. A 7/1 ARM, for example, has the same interest rate for the first seven years, before switching to the market rate. The benefit of using an ARM like this is that they often come with lower interest rates for the initial fixed-rate period.

For comparison, here are the mortgage rates at the time of writing:

Although ARMs got a bit of a bad reputation after the housing market crash, they can actually be a viable solution for obtaining a lower rate - especially if you don’t see yourself as likely to live in your property for the entire term length. Using a 5/1 ARM for a starter home you think you’ll sell in 5 years, for example, can be a great way to get a better mortgage rate and lower your monthly payments.

If you decide to keep the home and want to drop the ARM, you can always refinance (for a fee).

Fluctuating mortgage rates can make buying a home difficult. You could be approved for the current mortgage rate, only to find that once you’ve actually found your homes, the rates have gone up - altering which homes you can afford.

To help reduce the uncertainty, most lenders allow you to lock your rate, typically for either 30 or 60 days. Sometimes you need to pay a fee for this; other times this is already added into your mortgage rate itself. Although it’s possible to lock your rate for a longer period of time, you’ll need to pay extra to do so.

Locking your rate makes it easier to predict your future payments. However, keep in mind that it’s truly a locked rate - the lender can’t necessarily unlock the rate easily if interest rates go down. You may have to pay a fee in that situation.

“You can count on our team of professionals to monitor the market, therefore providing guidance as to the most beneficial time for the consumer to lock in their rate,” says Wagner.

Many buyers today are getting sticker shock from mortgage rates that increased rapidly from their historical low of around 3% last year. The difference between last year’s rate and this year’s rate for the average homebuyer translates into about a thousand dollars more per monthly payment - that’s a lot.

Mortgage points allow homebuyers to “buy down” their rate. One mortgage point is worth 1% of the loan total, and each point lowers the rate by about .25% (though this can vary).

So for a $400,000 loan, a single mortgage point would cost $4,000 and would lower the buyer’s rate from 6% to 5.75%.

You can buy more than one point, and you can even buy a fraction of a point.

Buying down your rate makes sense if you plan to live in your home for a while. If you plan on moving within 10 years, though, you might want to run the numbers first - it might make more sense to put that money toward your down payment.

Using Bankrate’s mortgage calculator, let’s walk through an example.

Say you plan on buying a $500,000 house with 10% down, meaning your loan amount would be $450,000.

If you decided to buy two mortgage points, they would cost 2% of the loan amount, or $9,000, and your mortgage rate would go from approximately 4.36% to 3.86% (since you reduced the rate by .5%)

So: buying two mortgage points upfront would net you $38,254 over the length of your loan (compared to keeping the $9,000).

However, this equation relies on you staying in your home and paying off the mortgage for the full 30 years. If you sell your home after five years, putting that additional $9,000 toward the down payment pays off the loan fastest, while buying points to lower your score results in the highest remaining loan balance.

In this 5-year scenario:

If this seems confusing, the key takeaway is that buying down points is most beneficial when you plan to live in your home longterm, because it knocks money off from each payment you make. If you sell your home in under 10 years, though, the gain might be quite marginal - if there is a gain at all.

Keep in mind that this is only a hypothetical scenario - so it always makes sense to consult with a mortgage advisor to find the most financially appropriate solution for your situation. Loan points, for example, are not exactly .25% off your mortgage rate each time - they can also fluctuate depending on market factors.

A 2-1 Buy Down temporarily lowers your rate. This allows you to have a rate that’s 2% lower the first year, and 1% lower the second year. This is funded by the home seller as a way to entice buyers.

It can be worth it for buyers who know they’ll be better able to handle the increased payment in the future. If someone is one year away from paying off their last car loan payment, for example, they know that they will soon have $400 more per month to put towards their monthly mortgage payment.

When you take out a home loan, the lender will typically require you to put down at least 3% of the home’s cost at closing - this is the down payment. The lender wants to know that you have some skin in the game yourself, and an incentive to keep paying off your mortgage.

Although the traditional rule was “put down 20%” on your home, this is becoming less and less common - especially with the rising cost of homes. Instead, as of 2021, the average was just 7% for first-time homebuyers and 17% for repeat buyers, according to the National Association of Realtors.

The benefit to putting down 20% is obvious - it lowers your monthly mortgage payments. And because your overall debt burden is lower, you’ll pay less in interest over time compared to someone who can only put down 5% or 10%. You also won’t need to worry about paying private mortgage insurance (PMI).

There are drawbacks to saving for 20%, however, because there is always a cost to not buying a home in the meantime.

If it takes you two extra years to save up enough for 20%, for example, that’s two years you spend paying rent to a landlord rather than putting money towards your own equity. Say that you pay $1,500 in rent every month - that’s almost $40,000 after two years that you’ll never see again.

The other side of the equation is that home prices will likely continue to rise. Although the market has been crazy lately, the normal appreciation rate for homes is 4%. So if the home you want is $400,000 now, after two years’ appreciation the market rate will be approximately $432,600.

In many cases, you’d be better off paying the $100 or so a month in mortgage insurance and getting into a home sooner, rather than later. Regardless of whether you want to put down 3% or 20%, we suggest running the numbers first to figure out what you’d save and what you’d spend if you wait to buy a home in order to save up for the down payment: everyone’s equation will look different.

Read more: How Much to Put Down on a House: the Problems with 20%

Plenty of people buy a home without being married - whether they're single, or buying a home with family or friends.

Buying a house with a friend is actually not that different from buying a home with a spouse, at least when it comes to the mortgage.

Regardless of your relationship to each other, the lender will consider the debts, income, and credit of all people applying for the loan. What's important to note is that when you apply together, the lender will base your rate on the lower credit score - your credit scores will not be averaged together.

Another thing to keep in mind is that once you have a home loan, the entire house is legally your responsibility - not just your "half." In other words, if your friend stops paying for their half of the mortgage, you risk defaulting on the entire loan. So it's a good idea to have savings and a plan in place in case something happens (like someone loses their job unexpectedly).

For more info: How Mortgages Work Without a Spouse

Moving in to your home is just the beginning. What's next?

You might be wondering whether there’s the potential for a tax write-off when it comes to your mortgage. The short answer is “yes, but you’re unlikely to use it.”

A tax expert is the best resource for making sure you’re maximizing your deductions, so take your questions there first.

When you have a mortgage, you can write off some of the interest you pay on the mortgage - and many potential homeowners see this as a potential trade-off.

However, the majority of homeowners don’t opt for the mortgage tax deduction. Why?

Investopedia ran the numbers for a household with $12,000 in mortgage interest and found that in every scenario (single or married), the household saved more money by taking the standard deduction. For a married couple in the 24% tax bracket, they would save $3,144 more by opting for the standard deduction.

Because most people already opt for the standard deduction - which doesn’t require receipts as proof - there is no appreciable difference to their taxes.

If you don’t pay your mortgage on time, you risk your house being foreclosed on. This is when the lender repossesses the house and sells it in order to make their money back. You will not receive any money from the sale, and it will stay on your credit report for seven years.

The foreclosure process varies by state, but typically, you will be considered in default after either 15 or 30 days of no payment. Then you will receive a notice of default (NOD) and you will have 90 days from that point to repay the lender.

If you’re at risk for foreclosure, always contact your lender - don’t ignore them. They can sometimes work with you on payments or direct you to agencies that help with financial counseling or assistance.

"At the first sign of financial distress, it is imperative that you call your lender. Most lenders will work with you to find a solution,” recommends Wagner.

A mortgage can be refinanced, a process where you receive a new loan to pay off and replace your original loan. This is a popular way to lower your monthly mortgage payment, reduce your loan term, withdraw equity from your home to finance projects or pay down debt, or to lower your mortgage rate. When mortgage rates dropped last year, refinance applications spiked.

That's all the basics! Are you ready to get started? Mortgage advisors won't charge you for their time - so you might as well benefit from expert advice!

Download the PDF version of this mortgage guide

Subscribe to our newsletter to get essential real estate insights.

Posted on Dec 16, 2022

Rates have risen to historic highs, and we're not sure they're coming back down anytime soon. Read...

Posted on Dec 16, 2022

Roughly 61% of home sellers are first-time home sellers. Not surprisingly, the average first-time...

Posted on Dec 16, 2022

According to the U.S. Bureau of Labor Statistics, there are almost 11 million independent...