Houwzer's Mortgage Guide: All the Basics, Explained

Posted on Mar 28, 2022

For homebuyers who can’t afford to buy their home in cash, a mortgage is a necessity. Yet despite a...

Posted on Mar 28, 2022

Roughly 61% of home sellers are first-time home sellers. Not surprisingly, the average first-time home seller has a lot of questions. Even seasoned home sellers have questions because the market and technology change quickly and, on average, people only sell their homes every eight years.

Selling your home is both a major life event and a major financial transaction. It pays to be an informed seller; you’ll maximize your home’s value while ensuring stress is kept to a minimum.

Our complete home selling guide is designed to walk you through every step of the process so that you’re fully prepared to sell your home. By the end, you’ll know how to extract the most value from your home sale and simplify the transaction, without adding work to your plate.

Sell my house! Jump to:

Download: the PDF version of this home selling guide

While there is some truth behind the idea that well-priced homes sell themselves, who you hire to sell your home matters more than most people think. The majority of people hire the first agent they meet–whether that’s at an open house, via a street sign, or through a family member or neighbor. Recommendations are helpful, but for a financial transaction this large, they should still be vetted through your own research.

At the very least, you should read their reviews and know the answers to these questions before you sign on the dotted line:

Having an experienced professional on your side will be your greatest asset in the home selling process. Here’s what you should consider:

Almost everyone knows someone who is a real estate agent. This can be really beneficial if that person is extremely qualified. It can also be extremely messy and put a strain on relationships if the person doesn’t have much experience or if things go sour on the deal. It’s worth asking yourself not only if the person is qualified to do the best job, but also if your relationship could be impacted.

Make sure that you’re comfortable with the agent’s skill level, and don’t feel guilty about hiring someone else for financial reasons or because you want to protect your relationship.

Becoming a real estate agent is much easier than it should be (and probably a lot easier than you would expect). By and large, the only criteria is taking the course–some which take less hours than one 40-hour work week–and passing the state licensing exam.

This structure has led to a large percentage of part-time and inexperienced real estate agents. Some work other jobs since there isn’t enough work to go around, and they need to put food on the table. Others picked up real estate as a side gig or a hobby to pass time in retirement.

Houwzer recognized that training is necessary in order to provide customers with better insight and support, advocate effectively in negotiations, protect the customer throughout the process, and counsel them through hard situations. Every agent at Houwzer must first go through extensive additional training, even if they’ve already worked in the field, before ever working with a client. In addition, all agents are full-time, salaried employees.

An experienced agent with the right tools and training will be able to help you sell your home for the most money, while simplifying the process and protecting you throughout in order to get the best results. No matter who you hire to sell your home, make sure they have a track record that proves they’re equipped to do the job.

It’s a common question. Most homeowners could do a For Sale By Owner, but ultimately opt not to because of three important considerations: time, effort, and getting a fair price. A good real estate agent can set an appropriate timeline and strategy for your home’s sale, and has built experience around getting fair offers. Here’s what you should know:

Operations Manager Ebony McCoy notes that homesellers might be surprised by just how much work Houwzer does on their behalf.

“You receive a full service experience with Houwzer. Along with having the expertise of an agent, we strategically market your home to the right people,” she explains.

Zillow's property search defaults to showing agent listings, putting FSBO home sales ("Other") at a disadvantageFull service real estate brokerages like Houwzer help you through the entire process, from consult to close. We provide professional photography (including 30 high-resolution photos and a 360° Virtual Tour), signage, mailed postcards, social and email marketing, and will organize open houses for your home (open houses are currently on pause due to coronavirus restrictions).

“You will have a better listing experience because we have a team supporting the success of your listing. The agent, a team of coordinators, marketing, leads, tech all working together to sell your home,” says McCoy of the Houwzer process.

Discount listing agencies handle the MLS and not much else, leaving you to coordinate open houses, professional photography, and more. For homeowners who are already busy with careers, kids, or other obligations, taking on the entire job of listing a home isn’t ideal.

Once you’ve found the right Realtor/agency for you, you’ll sign what’s called a listing agreement. This is a contract that gives the agent the right to sell your home, and establishes the agent fee or commission percentage. It also specifies that they have the right to advertise your home on the Multiple Listing Service (MLS).

Once you sign the listing agreement, you've agreed to sell your home exclusively with that brokerage. Depending on the terms you agreed to, the agreement usually expires after 3-6 months.

Ready to start your journey by getting in touch with a local Realtor?

How much does it cost to list and sell your home? Here’s what you need to know.

Once you’ve chosen a listing agent, the next step is setting up a listing consultation, and finding out how much your home is worth.

The next step of the home buying process is the answer to everyone’s question: how much is my home worth? There’s a few ways to answer this – and a few steps you should take.

During the listing consultation, the agent will take a tour of your home. They’ll point out potential problems, and suggest improvements. Their extensive experience will help you get the most realistic sense of what your home is worth.

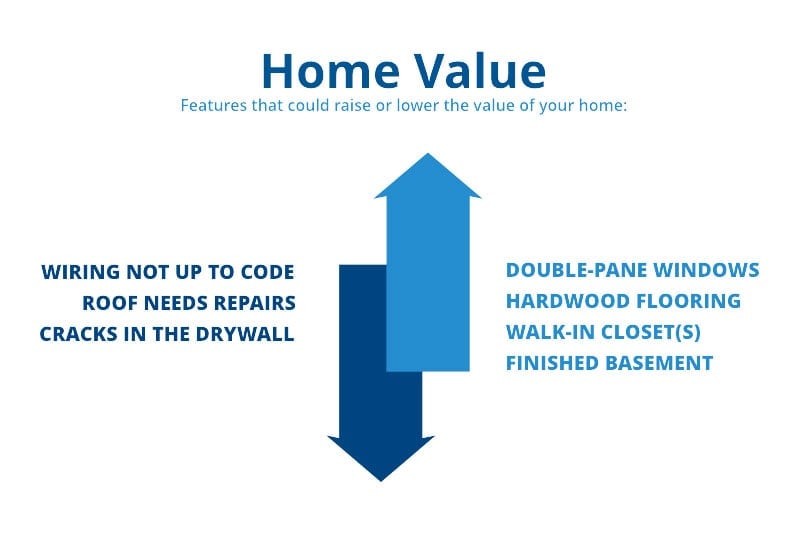

Features that could raise or lower the value of your home:

This is not intended to be an extensive list; just examples of the types of specific features agents are taking into consideration.

Even if a feature lowers the price of your home, our listing agents will typically not recommend extensive upgrade projects unless they seriously detract from the appearance of the home or are legally required. Why? It’s simple math. Your home will sell for more, but very few projects recoup their cost.

Many DIY-savvy first-time home buyers are actively searching for affordable homes they can renovate themselves, so there are still plenty of buyers who will buy your home as-is.

If you do want to make improvements to your home before selling it in order to net a higher asking price, prioritize improvements that appeal to millennials – they’re the largest group of homebuyers, representing 37% of the market. This generation prizes updated kitchens and baths, and rarely sees the appeal of wall-to-wall carpeting.

According to Realtor, these are three of the top updates millennials are looking for in for-sale homes:

An important part of determining your home’s value is the comparative market analysis, which is a review of what similar properties in your neighborhood have sold for over the past few months.

Your agent should be able to share online platforms with you such as Bright MLS and RPR, which can give you access to more information than what the general public can view.

Here’s what some listing agents are looking at for determining comps:

Real estate transactions are different from everyday transactions. If you go to the store to buy a box of cereal, the price generally stays the same regardless of how many people want to buy it. The price of your home, however, fluctuates constantly due to local supply and demand.

Understanding this will help you let go of expecting a price you think your home “should be.” What dictates your home’s price, ultimately, is the amount buyers are willing to pay – and this number can go up or down within the space of a year, or even a season.

The property disclosure, or seller’s disclosure, is an important document for the home selling process. This document outlines any potential issues that could impact a home’s safety or value, and the laws surrounding disclosure vary by state. Common issues noted in disclosure include, and are not limited to:

A failure to properly disclose these issues once you know of them can leave you liable for damages, even after the home has been sold. Some states require disclosure during the listing process; others only require it after you’ve accepted an offer.

The property disclosure benefits you, the seller, because it's a chance to clearly outline the existing issues with your home. This means there are fewer surprises on the inspection (better for negotiating), and it reduces your future liability.

Your listing agent will recommend a listing price, but it’s ultimately your choice. However, we highly recommend listing your home at its market rate. Many homeowners are tempted to list it higher – just in case someone will pay, to give room to negotiate, etc. And many agents will agree to list it high (and plan on lowering it later) in order to get a seller to sign their listing agreement.

This approach can backfire. Thanks to the internet, it’s extremely easy for buyers to know exactly how much a home is worth, and buyers will be hesitant to make an offer on an overpriced home.

“I don’t recommend people pricing higher than what they and their agent believe market value to be simply to build in room to negotiate,” says experienced listing agent Chris Johnson. “That can backfire and squander their early marketing period (first 7-10) days on the market which is the best time to attract qualified buyers who’ve been actively searching in the area.”

If you want to sell your home fast, sell it at a fair price and you could end up entertaining multiple bids. Alternatively, some sellers opt to price slightly under market value – “it can trigger an emotional response in buyers to compete,” notes Johnson. “And multiple offers give the sellers leverage to get the terms they want.”

During or shortly after the listing consult, you and the agent finalize an agreed upon price and listing dates.

See more: How to Sell Your House in 5 Days

Once you’re ready to list your home, it’s important to move quickly. The average home takes about 65 days to sell from start to close, but this number greatly depends on the local market (is there a lot of demand for homes in that neighborhood? That county?) and how the home is priced. Houwzer operates in several competitive markets, and many of our homes receive offers within the first two weeks – one recent Maryland-based client even received an offer 12 hours after listing. Here’s what you’ll be doing to make that happen.

Creating a listing profile is important – this is where you summarize your home and why people should want to live in it. Sometimes less is more, and it’s best to let an experienced agent lead on this and decide on what’s worth highlighting. Clients working with Houwzer are sent a survey through the online dashboard, and the responses are used to build their listing description – making the process pain-free and easy.

Professional photography is an important part of the listing process. About 90% of people now start their home search process online – often before even approaching an agent. Well lit photographs and detailed 360° virtual tours that highlight a home’s best features can help get more potential buyers to see your home.

Once your home is ready to go, it will be added to the Multiple Listing Service (MLS) by your agent. By uploading it to the MLS, your home will appear on sites like:

Ensuring maximum exposure. Once people are interested in actually seeing your home, showings can be requested via Showing Time, and open houses are advertised through a variety of third-party websites. Listings usually go live on Thursdays in order to prepare interested buyers for weekend open houses.

A sign will be installed in front of your home to let people know it’s for sale, as well as a lock-box for easy entry for home showings. Keep your home relatively clean and de-personalized so that it can be shown whenever buyers are interested.

“I recommend that sellers be as flexible as they can be in allowing as many potential buyers to come through their home as possible, particularly in their first 7-10 days on the market,” explains listing agent Chris Johnson. Johnson recommends keeping the notice window as short as possible – 2 hours is ideal.

If someone is interested in purchasing your home, their buyer’s agent will contact your listing agent, who will contact you. Once an offer is made, you’ll want to move fast!

Costly renovations may not be recommended, but small, inexpensive fixes definitely are. Homeowners might be surprised to discover that bright-colored accent walls rarely help sell a home: instead, neutral-toned walls work best. Now is also the time to fix the broken shower plug or testy door handle, lest a $20 repair turn off would-be buyers.

Open houses help to generate hype for your property, and they can be a good way to separate the wheat from the chaff. An open house allows for people with low purchase intent to see your home without taking up a lot of anyone’s time, leaving the showings for the truly interested buyers. And if serious buyers are in attendance, witnessing a well-attended open house can encourage them to come in with a high bid.

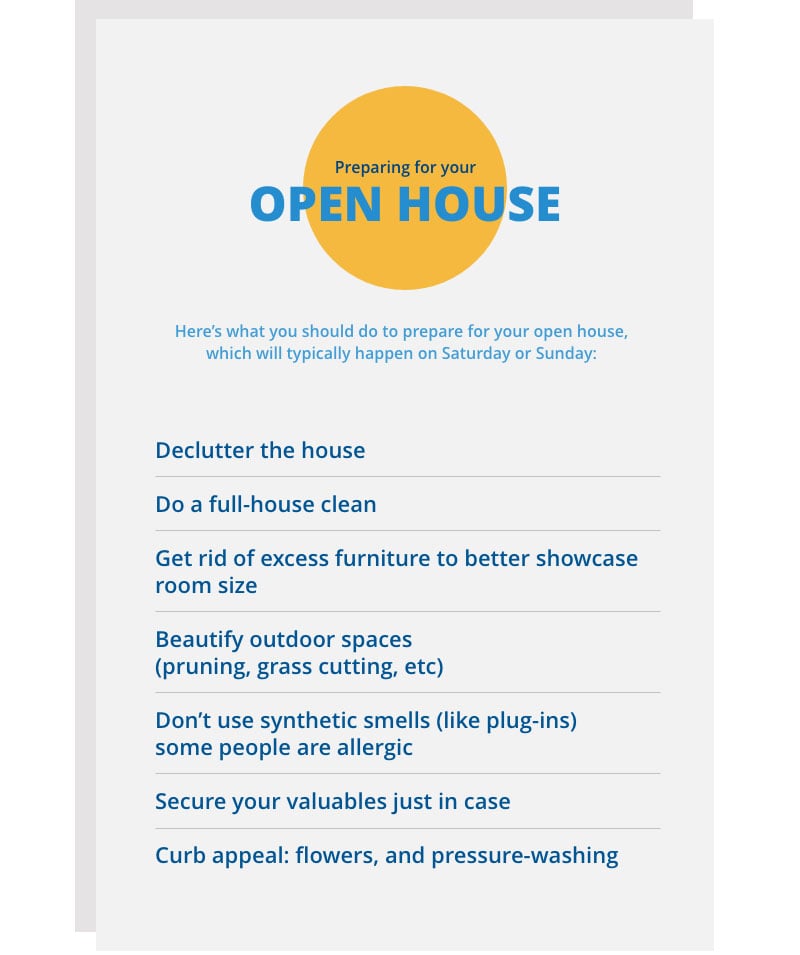

Houwzer will market your open house to ensure it gets as many interested buyers as possible. This includes advertising through social media. Here’s what you should do to prepare for your open house, which will typically happen on Saturday or Sunday:

An offer on your home allows you to potentially move forward with the process of selling your home. There’s a lot that goes into evaluating and accepting an offer, though. Here’s what you need to know.

There’s no right or wrong answer, since it will depend on what stage of the selling process you’re at, and the quality of the offer. If your home has been on the market for three months already, you’re unlikely to receive a higher offer later on – if anything, buyers may assume you’re desperate to sell (and willing to accept less than your home is worth).

On the other hand, if your home was just listed, you have more room to wait and see what happens. Buyers who come in with a low asking price, with contingencies, or without a mortgage pre-approval might not be the right match.

Ideally, you’ll have several offers to choose from. Here’s what you’ll be looking at closely:

Home sellers often prefer cash buyers, even if they come in with a slightly lower offer, because cash offers tend to close faster and are less likely to fall through due to financing issues.

If you need extra time to leave your home, you might consider asking for seller rent back contingency - this allows you to essentially "rent back" the house from the buyer for a period of 30 or 60 days.

The offer is a legal document. Home offers generally follow the Agreement of Sale (AOS) and usually include:

3. Offers can fall through

About 1-4% of pending offers end up falling through. Why? The top reason is financing; if a buyer has recently lost their job or taken on additional debt, their lender may revoke the pre-approval. A low appraisal or a home inspection contingency can also lead to a dropped sale.

If a homebuyer comes in below your asking price, if you receive multiple offers, or if the buyer asks you to complete certain renovations as part of the sale, there’s definitely room to negotiate.

It’s important to have an experienced agent on hand for this. Many Houwzer listing agents are trained specifically in negotiation tactics, ensuring that you’ll walk away from the deal with as much home equity as possible. There are a few different ways to counter an offer:

Once you accept the offer, it can take between 30-60 days to close the sale. Closer or farther out settlement dates are also possible, depending on your needs and the Buyer’s ability to match your goals. This allows you time to pack your belongings and move out – and possibly find a new home to move into, if you haven’t already.

Congratulations on selling your home! What comes next?

Keep track of all the documents related to your home’s sale. The new homeowner will receive the original Deed to your house, while the Deed of Trust goes to their lender.

If you’re in the market for a new home, keep in mind that homeowners who buy, title, and mortgage with Houwzer receive a $2,500 rebate at closing that can be used for anything – their down payment, home renovations, or even just paying off bills.

“This was a great experience at a really great price,” wrote client Sharon Henahan about her experience with Houwzer in a 5-star Facebook review. “We had the full professional treatment of great house photos, an open house, easy-to-use online app, quick responses by phone, text, and email. I would recommend Houwzer to anyone.”

A good final step in the home selling process is sharing the story of how your experience went (whether that's good or bad). Online reviews help future clients determine the best option for selling their home, and also give your listing agent valuable feedback on what they can do to improve.

Subscribe to our newsletter to get essential real estate insights.

Posted on Mar 28, 2022

For homebuyers who can’t afford to buy their home in cash, a mortgage is a necessity. Yet despite a...

Posted on Mar 28, 2022

Anyone who’s recently looked into how to save money when selling a home has likely encountered...

Posted on Mar 28, 2022

Approximately 37% of households in Orlando own their home, and more people are joining their ranks...